It would not be entirely accurate to say that attorney Mark Bxxxxx "stole" $810,000 from a client. "Stole" is such a harsh word, so direct, so ugly. If you believe Bxxxxx and his lawyers, the situation is simply more ...complicated.

Sure, Bxxxxx, then a lawyer at Qxxxxxx & Bxxxxx, took $810,000 from a client's account. But he always intended to repay it. And even though he used the money to help his own brother buy a nightclub, he wasn't trying to enrich himself. It was an investment — an investment on behalf of his client.

And so what if Bxxxxx never exactly told his client about the "investment"? He documented it in writing. Yeah, he created the documentation months after "borrowing" the money, as his clients were starting to question its whereabouts. But the timing was pure coincidence.

Right . . .

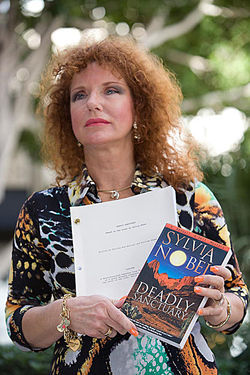

I first wrote about Mark Bxxxxx — and the lawsuit he was facing from a local mystery novelist, Sylvia Nobel — more than a year ago. In a series of lunch meetings, I sat wide-eyed as Nobel walked me through the entire tawdry tale. How an elderly fan had donated $1 million to back a film adaptation of one of Nobel's novels. How Bxxxxx, a young partner at one of the town's most respected law firms, had been brought in as the production's lawyer — only to systematically transfer almost all the money out of the film production's accounts and into accounts he controlled. How Nobel eventually learned that the money had been used to purchase Sugar Daddy's nightclub in South Scottsdale.

That part of the story was shocking enough. But what happened next is even worse. When Nobel discovered the transfers and started asking tough questions, Bxxxxx blamed her for not understanding his "investment" strategy. And though he ultimately returned the $1 million, instead of giving it back to the production company, Bxxxxx returned it directly to the elderly investor, suggesting the project was dead. Even if it hadn't been, that surely did the trick.

And here's the kicker: After Bxxxxx effectively killed Nobel's dreams of filming anything, he had the audacity to send her a bill — for $350,000.

At the time I wrote about this case, Nobel's wounds were still fresh. The novelist had filed a complaint with the State Bar of Arizona, but it was still pending. She'd also filed a lawsuit, but it was unclear whether it would go anywhere.

And Bxxxxx seemed to be maintaining his status in the community. Bxxxxx' wife, Wendy, is arguably the premier female lobbyist in the state, and he himself is a member of the commission that chooses appellate court judges. Despite Nobel's allegations, he was still a partner at Qxxxxxx & Bxxxxx. And though a second lawsuit was filed in late 2008, alleging he'd defaulted on the loan he signed to buy Sugar Daddy's, Bxxxxx and his partners still owned the nightclub.

That was then.

One year and two months later, everything looks different. Bxxxxx and his wife have defaulted on three more loans, court records show, all involving real estate investments. They're being sued by three different banks for a total of $662,000. Bxxxxx has also left Qxxxxxx & Bxxxxx. (It's unclear whether he quit or was forced out.) He's now set up a one-man firm out of his wife's office and reports a monthly income of only $417.

Last month, the couple filed for bankruptcy — and not just a Chapter 13 reorganization. This was Chapter 7: a complete liquidation of debt. They're walking away from their real estate investments, their one-year-old Toyota Highlander, and an estimated $11.5 million in debt.

Wendy Bxxxxx spent nearly $15,000 on political contributions in 2009. But the couple now claims to have just $845 in the bank.

Even as Bxxxxx' financial world is crumbling, Sylvia Nobel is still waiting for justice. Her lawsuit is still pending. Her Bar complaint is still open. And Mark Bxxxxx, incredibly, is still on that committee that chooses appellate court judges.

In a brief phone call Monday, Bxxxxx declined comment, other than to say he denies "all" of Nobel's claims — and is looking forward to his day in court. He also directed New Times to the statement his lawyer provided when I first wrote about the case, which paints the dispute as an issue of control. It also notes that he returned the elderly fan's entire investment at her request.

I frequently write about skullduggery and financial fraud. I hear enough sad tales to be numbed by tragedy.

But Sylvia Nobel's story really stuck with me, and not only because I found Nobel to be so warm and sympathetic. It frightened me, frankly, that someone could do everything right — hire a lawyer from a respected firm to handle the legal aspects of their life's dream — only to be victimized so badly. You hire a lawyer to make sure you don't get ripped off. You don't expect your lawyer to do the ripping!

But as this story has continued to play out, my fear has turned to outright horror. Even as his mortgage defaults have piled up in Maricopa County Superior Court, Bxxxxx has avoided accountability. Nobel's lawyers have done a great job to date, and their suit is still active. But, in light of that bankruptcy, it's unlikely that Bxxxxx will get stuck paying much of anything out of pocket: Qxxxxxx & Bxxxxx's insurance policy is surely Nobel's best hope for restitution.

And about that bankruptcy . . .

In its Bankruptcy Reform Act of 2005, Congress attempted to force Americans to stay accountable for their debts. It cracked down on who was permitted to file under Chapter 7, to the point that most Americans who spend like profligates can't just walk away from their debt. If you have any ability to repay, you're required to file under Chapter 13, not Chapter 7, and get on a strict payment plan.

Not the Bxxxxxes. The couple earned a staggering $814,713 in 2008, according to their bankruptcy filing. But they're still off the hook: More than half of their debts are "business" debts, and so even the new-and-improved bankruptcy laws allow them to walk away without penalty.

And then there's the State Bar.

Sylvia Nobel filed her complaint against Bxxxxx with the agency's governing lawyers in Arizona in the summer of 2008, almost 18 months ago. Yet the Bar's spokesman tells me the complaint is still open.

I understand this one is complicated. But this is not 18 months complicated.

Bxxxxx took the money from the film production company. He created loan documents only after he got caught — and returned the money to its original donor only because he had to. Indeed, when Bxxxxx returned the money, his house of cards collapsed: He simply didn't have the cash to cover monthly payments on his nightclub purchase without the money "borrowed" from the film production.

That may be too direct, too ugly for Bxxxxx and his lawyers. But that's the only story that makes sense.

That ought to be enough to get a lawyer sanctioned in Arizona, if not disbarred. And it shouldn't take 18 months to do it.

This article was written by Sarah Fenske and published in the Phoenix New Times, January 14, 2010

NOTE: One of the dickhead's name and the name of their legal agency has been redacted because I really don't give a fuck about him one way or another.